Chapter-1: Mutual Fund Basics

This deals with MF definition, basic research websites, short-term selection criteria, various short-term funds available in the market

- What is a Mutual Fund?

A mutual fund is a type of investment fund that pools money from many investors and invests the same money in different companies (usually 30 to 40 companies) which are expected to perform well soon. These funds are managed by some financial experts who are known as fund managers.

1.1 The pooled money may be invested by the managers in two ways-

- First, the pooled money is used to purchase the share of high-potential performing companies, and as the share price increases the mutual fund values will rise, and the investors’ money will also go up. This type of fund is called an equity mutual fund.

- Second, the pooled money is given to companies at a certain rate of interest for a fixed or variable duration thus returning with time already known. Such returns are the least risky but with less return value. This type of fund is known as a debt mutual fund. The fund manager tries to select those companies that have a good financial base and the chances being its default is the least.

If the above funds invest the money at low risk the return will be lesser and if funds will invest the money at high risk the fund safety will be compromised thus it is the role of the fund manager to optimize the output of the fund.

With the development of different financial web/app platforms, the investment in these funds has not only become easy but any amount (As little as 100 INR or higher of any value) also can be invested.

The mutual funds can be easily analyzed through the following websites-

- Money Control Website

- Value Search Online Website

https://www.valueresearchonline.com/

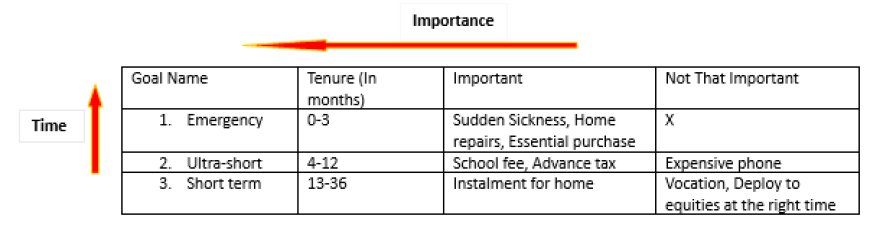

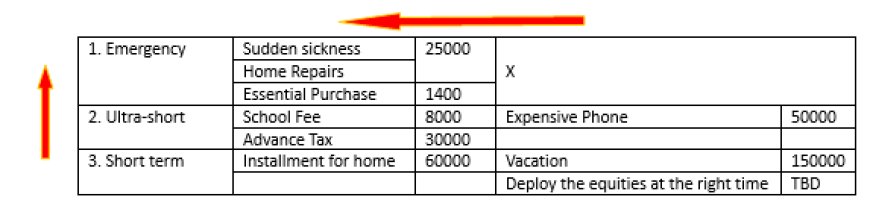

2. Define Short-term Investment (Time vs Importance Facts-)-

Time vs. importance tabular representation shows that where time and importance are higher (emergency), you should invest your money into the instruments of lowest risk which affects the savings and fixed deposit.

2.1 Short-term investment selection criteria-

- Safety of capital- Every investment has a certain set of risks in mutual funds the ups and downs of net asset values while in banks there are rare chances of the collapse of banks.

· Analysis of mutual funds adopted for short-term investment

|

Fund category |

Scheme plan |

Negative return days |

Total days |

Non-negative occurrences (In %) |

|

Overnight |

L & T overnight fund |

1 |

1808 |

99.9 |

|

Liquid |

Quant liquid fund |

3 |

1808 |

99.8 |

|

Ultra-short term |

Kotak savings fund |

84 |

1808 |

95.4 |

|

Low duration |

Axis treasury advantage fund |

137 |

1808 |

92.4 |

|

Money market |

Kotak money market fund |

36 |

1808 |

98.0 |

|

Short duration |

ICICI Prudential short-term fund |

336 |

1808 |

81.4 |

· This indicates that if you want extra safe go for a savings bank account deposit or fixed deposit. If you want a bit higher return than bank savings with marginal higher risk, go for Overnight or liquid fund investment.

- Liquidity or accessibility- Available as and when required, the most accessible modes with ease and speed of getting money are-

· Bank account- can get money any time using a debit card, net banking, UPI

· Fixed deposit

· Debt mutual fund- Money redeeming and getting into your bank a/c may take 2-3 business days.

- Returns- Give higher returns in comparison to other regular options

- NSC, fixed deposit is the safer option

- Debt fund and liquidity adoption needs extra carefulness like-

· Safety and liquidity are important parameters

· Do not chase top-performing fund

· Evaluate returns on a post-tax basis

|

Fund category |

Scheme plan |

2016(%) |

2017(%) |

2018(%) |

2019(%) |

2020(%) |

2021(%) |

|

Overnight |

L & T overnight fund |

7.3 |

6.2 |

6.3 |

5.7 |

3.4 |

2.0 |

|

Liquid |

Quant liquid fund |

8.0 |

6.6 |

7.4 |

7.4 |

5.3 |

2.7 |

|

Ultra-short term |

Kotak savings fund |

8.5 |

7.0 |

7.7 |

8.2 |

6.3 |

2.3 |

|

Low duration |

Axis treasury advantage fund |

8.6 |

7.2 |

7.8 |

9.1 |

7.6 |

2.7 |

|

Money market |

Kotak money market fund |

7.7 |

6.7 |

7.7 |

8.1 |

5.7 |

2.4 |

|

Short duration |

ICICI Prudential short-term fund |

11.8 |

6.8 |

6.7 |

10.5 |

11.4 |

2.9 |

2.2 Set up the short-term investment plan

· Emergency funds can be saved under-

Ø Saving Account

Ø Overnight fund

Ø Fixed Deposit

Ø Liquid funds

· Little important goals related to money can be saved under (6 to 18 months)-

Ø Ultra-short-term fund

Ø Low duration fund

Ø Money market fund

Ø Arbitrage funds

· Checkpoints for debt selection

o Easy method, Select the investment apps and look for the parameters relevant to you

o Difficult method- Manual checkup for parameters

Ø Check1: Lok the modified duration- Lower that number, the better it is because it represents that the interest rate will remain almost stable with time which is critical for short-term investment.

Ø Fund avg maturity<=Category avg maturity, this check whether the fund has any long-duration papers which may lead it to risk.

Ø Yield to maturity (YTM) is close to the category’s YTM, Higher YTM represents that fund is taking a high risk by taking low-rated papers or by conducting debt placements thus not recommended.

Back To Main Page

What's Your Reaction?