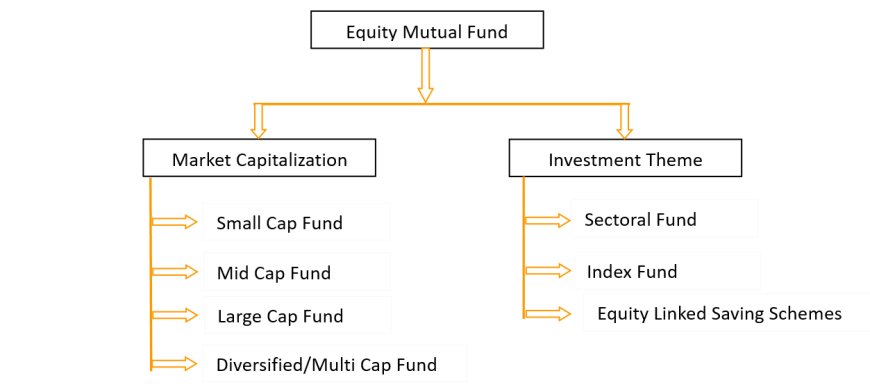

Chapter-4: Equity Mutual Fund

This chapter deals with the different types of equity mutual funds based on various parameters.

4.1 Equity Mutual Funds

Equity mutual funds are those funds that largely invest in company stocks to generate the intended high returns. Equity mutual funds are subjected to higher risk compared to other forms of mutual funds. There is a variety of equity mutual funds that maps different risk level and as per the investment objective, an investor should select them.

4.1.1 Types of Equity Funds

4.1.1.1 Based on Market Capitalization

The term market cap refers to the value of total outstanding shares trading in a stock market.

- For example, if a company has 1 million shares and sells each at 10 INR per share then the company will have a market capital of 10 million rupees.

4.1.1.1.1 Small Cap Fund

Small-cap equity funds invest in the smallest companies in India. These are the companies that are beyond the top 250 companies and most of the companies are unknown to the general public. The basic characteristics are-

- These companies are extremely volatile and may cause huge losses from mid to short terms of the investment.

- As per SEBI norms, the funds must invest at least 65% of their funds in equity and equity-related instruments of small-cap listed on the NSE or on the BSE.

- These companies are ideal for aggressive investors with 7+ years of investment.

- The small companies may be the top business in the upcoming future thus will be a high return.

4.1.1.1.2 Mid Cap Fund

Mid-cap mutual funds are equity funds that invest in medium size companies in India. Mid-size companies are those companies that are fastest-growing companies. The basic characteristics are-

- As per SEBI, mid-cap companies rank 101st to 250th in terms of market capitalization in an index.

- Nifty Mid-cap 100 at NSE and BSE mid-cap index at BSE represent the performance of the top 100 companies in the mid-cap segment.

- These companies have high growth expectations than large-cap companies.

- As per SEBI norms, such mutual funds must have invested a minimum of 65% of their total assets in equity and equity-related investment instruments of mid-cap companies.

4.1.1.1.3 Large Cap Fund

Large-cap mutual funds are equity funds that mainly invest in top-ranked 100 companies in India. These companies are some of the biggest brands and many of them are even what we were using in our day-to-day life. The properties of such funds are-

- Large-cap companies are the first 100 companies listed on BSE or NSE and these mutual funds are bound to invest at least 80% of their funds in such size companies’ equity or equity-related instruments. The investment-related norms are governed by SEBI guidelines.

- These funds are less volatile and have consistent profit throughout the tenure.

- Ideal investment period is at least 5 years in such mutual funds.

4.1.1.1.4 Hybrid or Multi Cap Fund

Multi-cap equity funds invest in companies of all sizes and throughout all sectors. As per the SEBI norms, these funds must invest at least 25% each in stock of each category. The properties of such funds are-

- Eliminates the need of buying different equity-based mutual funds.

- Ideal investment period is at least 5 years in such mutual funds.

4.1.1.2 Based on Investment Theme

Theme-based funds are those investment funds that are focused on a specific theme or trend. These funds are generally open-ended funds that invest in predefined themes such as clean energy, Dark web. These are futuristic approach funds and gain profit with time.

4.1.1.2.1 Sectoral Fund

Sectoral funds are equity funds that invest in a specific sector of the economy. These sectors may be technology, agriculture, energy, etc. Based on sectors the funds may be of the following types-

ü Real state funds

ü Utility Funds

ü Natural resource funds

ü Technology funds

ü Financial funds

ü Healthcare funds

ü Precious metal funds

ü Communication funds

4.1.1.2.2 Index Fund

An index fund is a type of mutual fund with a portfolio constructed to match the components of a financial market index. The primary goal of such funds is to replicate the stock market index. The fund manager works passively thus cost of managing such funds is less.

- For example, a Nifty index fund will invest 5% in ITC if the Nifty has given 5% weightage while indexing it.

4.1.1.2.3 ELSS

ELSS is an abbreviation of Equity Linked Saving Scheme which is an open-ended equity mutual fund. Such funds are designed to invest in equities and equity-related products. They are the special category of funds that qualify for tax deductions under section 80C of the IT Act, 1961. Other details are-

ü These investments have a lock-in period of 3 years without having any option of premature exit.

ü As per SEBI norms, 65% of the funds is invested in equities although some % of the fund can be invested in fixed-income securities as well.

ü Maximum any amount one can put but tax rebate can be claimed only for 1.5L.

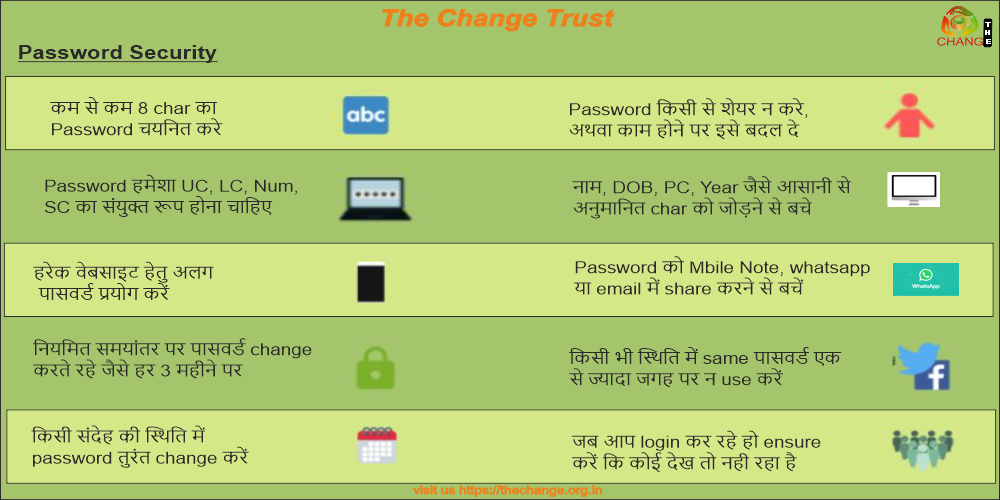

What's Your Reaction?