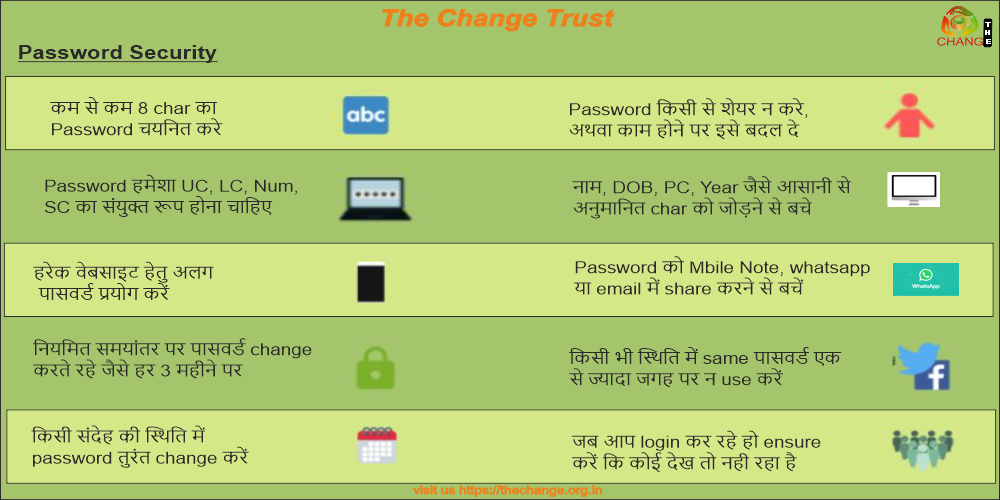

Chapter-8: MF Buy Sell and Return Guide

This chapter explains in short about buying mutual funds, sale of mutual funds, and also what are the tentative long-term returns.

8.1 When to Buy Mutual Funds

8.1.1 Liquid fund

Liquid funds can be bought anytime.

8.1.2 Short-term fund

For moderate return investment and can be bought anytime.

8.1.3 Equity fund

One cannot purchase a lumpsum amount in an equity fund.

8.2.1 When you need money

Sometimes, investors have urgent money requirements in different forms in such a scenario the investor does not have any choice as to whether the time is appropriate for exit or not but they have to make an exit anyway.

8.2.2 Achieved the goals

This is the completion of targeted goals such as education of the child, buying a car, or buying a home. Once you are near the target try to switch from equity-based investment to debt-based investment slowly and systematically.

8.2.3 Fund Manager

If the fund manager is doing well with the funds and he left the job or switches to other AMCs in such a scenario, just wait and watch the fund situation for 6 months to one year. If the fund is still declining or not doing well try to switch it.

It can be noted that a consistent performing manager with less return is better than high performing risk-taking manager until the fund is performing compared to peers.

|

Year |

Manager A |

Return % |

Manager B |

Return % |

|

Current Return % |

20% |

15% |

||

|

Years \ Initial Investment |

50000 |

50000 |

||

|

1 |

60000 |

1.2 |

57500 |

1.15 |

|

2 |

72000 |

1.2 |

66125 |

1.15 |

|

3 |

86400 |

1.2 |

76044 |

1.15 |

|

4 |

103680 |

1.2 |

87450 |

1.15 |

|

5 |

124416 |

1.2 |

100568 |

1.15 |

|

6 |

149299 |

1.2 |

115653 |

1.15 |

|

7 |

179159 |

1.2 |

133001 |

1.15 |

|

8 |

197075 |

1.1 |

152951 |

1.15 |

|

9 |

157660 |

0.8 |

175894 |

1.15 |

|

10 |

126128 |

0.8 |

202278 |

1.15 |

8.2.4 Fund is not performing well

Watch the fund performance and compare with peers and benchmark properly and if you found the fund is not performing well switch to other options.

v Sensex started from a value of 100 and now the 66695 in the last 45 years have 16% of the return thus while investing in equity one should look for 16% return.

|

SENSEX |

Year |

Value |

Rate |

16% |

|

Starting Year |

1978 |

100 |

Period |

45 |

|

Present Year |

2023 |

66795 |

Amount |

-100 |

|

Change |

45 |

66695 |

FV |

66695 |

v While investing in mid-term instruments one should expect 8-10% of the return which can be considered as a benchmark.

v While investing in short-term instruments one should expect 6-8% of the return which can be considered as a benchmark.

What's Your Reaction?