Chapter-7: MF Portfolio Selection

This chapter deals with the parameters need to be considered while selecting a mutual fund.

1

7.1 Funds Objective

Every fund’s objective has been written in fund details and the objective of the investor should match with the same.

7.2 Expense ratio

The expense ratio indicates the expense required to manage the funds irrespective of the nature of the fund’s nature of growth. This can badly impact if the return is 6-8% and the expenses ratio is 1-2% then funds are not known well.

Funds should be chosen with the lowest possible expense ratio but the lowest expense ratio is not the only selection criteria of investment. It should be comparable with other funds too.

For example,

Use formula FV=FV (Interest rate, investing no of years, 0, Invested amount with -ve sign) in Excel.

|

Interest Rate |

15% |

14.5% |

14.0% |

13.5% |

13.0% |

12.5% |

|

Investing no of years |

20 |

20 |

20 |

20 |

20 |

20 |

|

Invested Amount (INR) |

-1000000 |

-1000000 |

-1000000 |

-1000000 |

-1000000 |

-1000000 |

|

Future Value (INR) |

16366537.39 |

15000638.1 |

13743489.87 |

12586855.04 |

11523087.76 |

10545093.84 |

|

Expense Ratio |

0.5 |

1 |

1.5 |

2 |

2.5 |

|

|

Loss of Fund |

1365899 |

2623048 |

3779682 |

4843450 |

5821444 |

|

From the example, if one had invested 10L for a fixed term of 20 years with an expense ratio of 0.55, will have a loss of 13 lakh while the same amount if subjected to an expense ratio of 2 % only, will incur a loss of 48 lakh, which is a big amount.

7.3 Fund manager’s track record

The fund managers’ past records can be assessed by using suitable software like https://www.valueresearchonline.com/.

- Google search about fund manager

- Valueresearchonline, peer analysis

7.4 Fund’s Performance Evaluation

The fund must be compared through a certain bench of that fund and a comparison needs to be done. The following are the ways to make a comparison-

7.4.1 Compare with reference

Credit: Valueresearchonline.com

Here the fund is compared through its benchmark S & P which clearly shows that when the benchmark is – ve the fund down performs less but it is high the fund performs well.

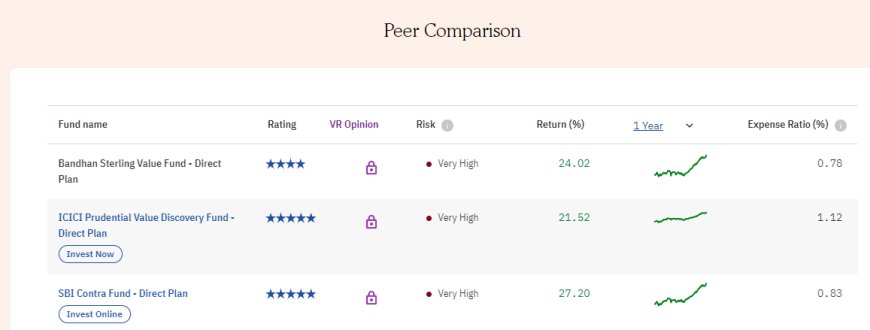

7.4.2 Peers

The nearby fund to the selected fund should be analyzed.

7.4.3 Performance in Rising and falling Markets

This indicates the performance of the fund with respect to the market ups and downs and how the funds are acting.

7.4.4 Time factor

This indicates the duration of investment which is important and should be chosen as per the objective of investment. For example, If the objective is to earn money, invest min for 3 years.

7.4.5 Vast outperform is not always desirable

Never chase the high-performing fund as it may reduce with time and may cause serious damage of investment.

7.4.6 Mutual fund rating

The funds are rated at various websites, one can research for this.

What's Your Reaction?